Buying your first home in South Jersey is a major milestone — and a smart investment in your future. Whether you’re looking in Cherry Hill, Merchantville, Pennsauken, or down the shore, understanding how to budget the right way can mean the difference between financial confidence and costly surprises.

This guide breaks down exactly how first-time home buyers in South Jersey can create a practical home-buying budget, prepare financially, and take advantage of local programs designed to make homeownership easier.

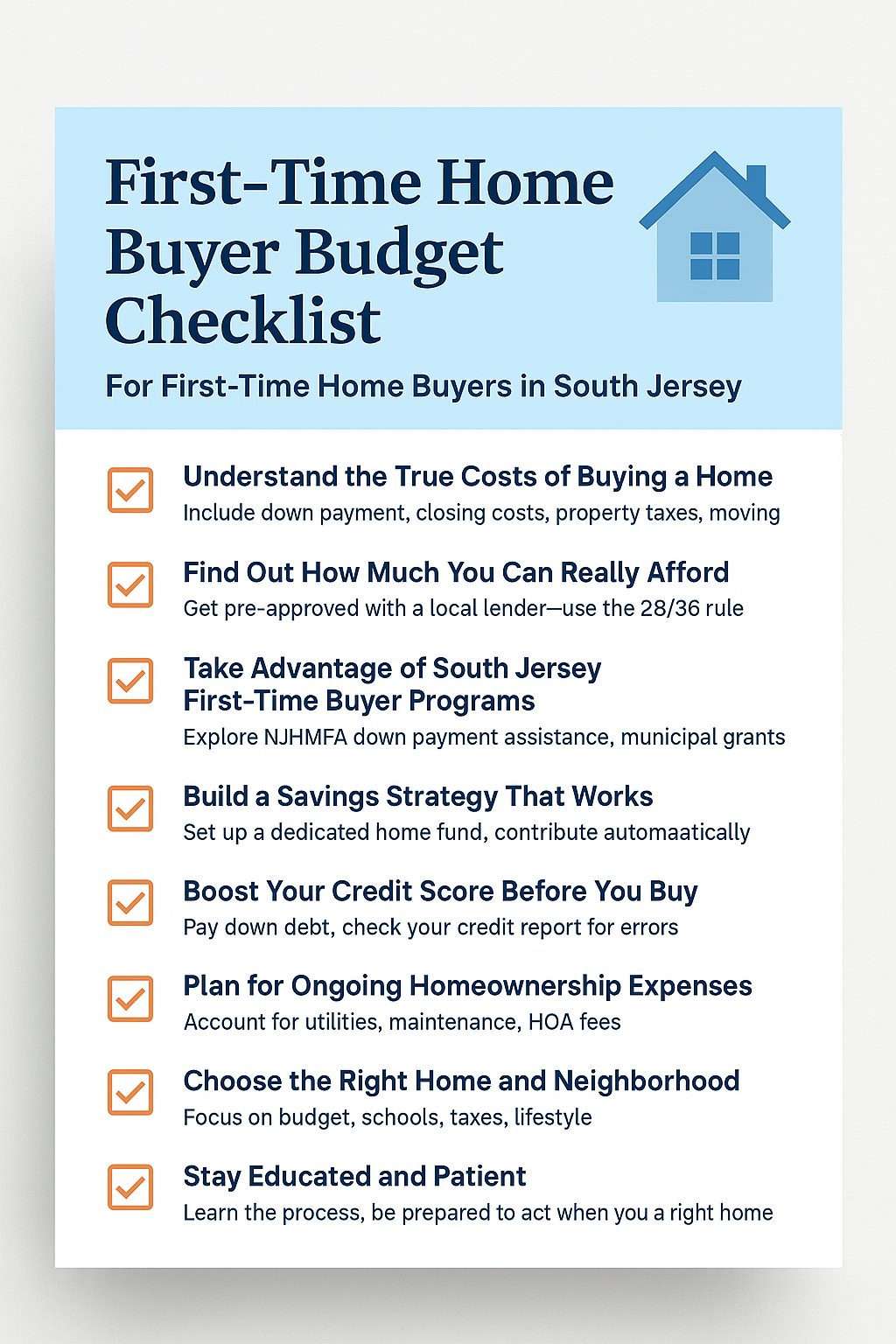

1. Understand the True Costs of Buying a Home

Many first-time buyers focus on the list price, but your budget should include all the costs that come with buying a home in South Jersey.

Here’s what to expect:

-

Down Payment: Most lenders require between 3% and 20% of the purchase price. FHA loans can go as low as 3.5%.

-

Closing Costs: Expect 2–5% of the loan amount. This covers title fees, attorney costs, appraisal, and inspections.

-

Home Inspection: Typically $400–$700 in South Jersey depending on property size and age.

-

Property Taxes: South Jersey towns vary — for example, Cherry Hill averages around 3.1% of assessed value, while smaller towns like Merchantville are slightly lower.

-

Moving Expenses: Budget for trucks, movers, and utility hookups — often $1,000–$2,500.

Pro Tip: Add at least $5,000–$10,000 in reserves to handle unexpected expenses or repairs after move-in.

2. Find Out How Much You Can Really Afford

Before falling in love with a home, talk to a local South Jersey mortgage lender and get pre-approved. Use the 28/36 rule as a guide:

-

Housing costs (mortgage + taxes + insurance) should not exceed 28% of your gross income.

-

Total monthly debt (including car and credit cards) should stay below 36%.

Even if you’re approved for more, don’t max out your budget — South Jersey’s property taxes and insurance rates can vary widely between counties.

Local Insight: Camden and Burlington County homes may have higher taxes than Gloucester or Cumberland, so compare total monthly costs, not just price tags.

3. Take Advantage of South Jersey First-Time Buyer Programs

There are excellent New Jersey programs designed to help first-time home buyers:

-

🏠 NJHMFA Down Payment Assistance Program: Offers up to $15,000 in forgivable loans toward your down payment or closing costs.

-

💰 HomeReady® and Home Possible® loans: Designed for low-to-moderate income buyers with flexible credit requirements.

-

🌆 Municipal Grants: Cities like Camden, Vineland, and Atlantic City occasionally offer local housing incentives — check each city’s website.

Pro Tip: Working with a local Realtor familiar with these programs (like those at EducatedHomes.com) ensures you don’t leave free money on the table.

4. Build a Savings Strategy That Works

Set up a dedicated “home fund” and contribute automatically each paycheck. A realistic South Jersey savings plan might look like:

| Expense | Target Amount |

|---|---|

| Down Payment | $15,000 |

| Closing Costs | $7,500 |

| Emergency Fund | $5,000 |

| Moving & Furniture | $3,000 |

| Total Goal | $30,500 |

Pro Tip: Keep your emergency fund separate — don’t drain it for your down payment. Homeownership brings ongoing maintenance costs.

5. Boost Your Credit Score Before You Buy

A few points on your credit score can make a big difference in your mortgage rate. To prepare:

-

Pay down revolving debt (credit cards).

-

Avoid opening new accounts before closing.

-

Check your report at annualcreditreport.com for errors.

-

Keep credit utilization below 30%.

A higher score could save you tens of thousands of dollars over the life of your loan.

6. Plan for Ongoing Homeownership Expenses

Once you buy, your monthly budget will include more than your mortgage:

-

Property Taxes & Insurance – vary by township.

-

Utilities – electric, gas, water, and internet often total $250–$400 per month.

-

Maintenance & Repairs – aim to save 1% of your home’s value per year.

-

HOA Fees – some condo and townhouse communities in South Jersey charge $100–$350/month.

Example: If your home is worth $350,000, plan to save $3,500 per year for maintenance.

7. Choose the Right Home and Neighborhood

South Jersey offers everything from walkable historic towns like Haddonfield and Merchantville to newer suburban communities in Voorhees or Mount Laurel.

When shopping:

-

Compare school districts, commute routes, and tax rates.

-

Don’t rush — view several homes to understand market value.

-

Focus on what fits your budget and lifestyle — upgrades can come later.

Working with a local Realtor who knows the neighborhoods gives you an advantage when bidding and negotiating.

8. Stay Educated and Patient

The South Jersey housing market can be competitive, especially for first-time buyers. Take your time, learn the process, and lean on professionals.

Explore:

-

Mortgage types (FHA, conventional, VA, USDA)

-

Inspection and appraisal processes

-

Homeownership classes through NJHMFA

Remember — the right home is one you can afford comfortably, not one that stretches your finances thin.

💡 Final Thoughts

Buying your first home in South Jersey is a major accomplishment — but it starts with a smart budget and local knowledge.

Take advantage of New Jersey’s first-time buyer programs, work with a trusted agent, and prepare financially so you can enjoy your new home with confidence.

Your dream home is waiting — plan wisely, save steadily, and make your first home purchase a lasting success.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link